CFIUS Releases 2021 Annual Report

August 22, 2022

What Happened:

On August 3, 2022, the Committee on Foreign Investment in the United States (CFIUS) released its annual report for calendar year 2021 (the Report). The Report provides to the public the first full year of data regarding CFIUS activities since the implementation of the 2020 rule changes mandated by the Foreign Investment Risk Review Modernization Act (FIRRMA).

The Bottom Line:

The Report discloses a number of trends and developments regarding submissions to, and the activities of, CFIUS including:

- Filing parties — particularly those based in countries that are close political and military allies of the United States — appear to be increasingly willing to file using the short-form “declaration” rather than the longer-form “notification.”

- The number of notices filed in 2021 increased significantly from 2020. At the same time, the Report shows a significant increase in 2021 relative to 2020 in the number of notices withdrawn and re-filed. About half of the increase in notice filings appears to have resulted from the notice withdrawals followed by re-filings.

- There was a significant uptick in the aggregate number of declaration and notice submissions to CFIUS (declarations and notices totaled 313 and 436 respectively in 2020 and 2021). While China remains a significant acquirer of US assets and a significant participant in the CFIUS clearance process, the aggregate number of declaration and notice filings by each of Japan and Canada surpassed those by China in 2021.

- The Report gives us the most detailed look yet into CFIUS activities regarding “critical technologies.” Insofar as mitigation is concerned, the sizeable increase in withdrawals and re-filings suggests that, where parties have identified serious potential national security issues, there is a substantial risk that the time to complete CFIUS review and negotiate a mitigation agreement will not be accomplished within the standard time periods contemplated by FIRRMA.

- Submissions to CFIUS regarding “covered real estate transactions” — which were given their own set of CFIUS rules in connection with FIRRMA implementation — appear to be few and far between.

We discuss these highlights further below.

The Full Story:

Declarations

There were 164 declarations filed in 2021 compared with 126 in 2020 and 94 in 2019 (about a 30% increase).1 Approximately 73% of cases notified by declaration in 2021 were cleared by CFIUS (compared with 64% and 37% in 2020 and 2019 respectively). In 2021, CFIUS only directed the parties to make a notice filing in about 18% of cases (compared with 22% and 28% for 2020 and 2019 respectively). For 2021, the clearance rate for declarations appears to be nearly the same as the rate for clearance on notices.

These trends indicate growing acceptance of the declaration process on both the part of CFIUS and filers. In 2021, though the number of declarations increased significantly, CFIUS’s clearance rate also increased. The decision of whether to file a declaration or a notice remains a key issue in considering a CFIUS filing, and filers should be informed by a number of factors, including transaction complexity, potential national security sensitivities, timing, and investor nationality.

The top six filers of declarations in 2021 by country of origin — Canada (22), Germany (11), Japan (11), Singapore (11), South Korea (11) and the United Kingdom (10) — accounted for 76 of the year’s declaration filings (or over 46%). Declarations filed acquirers or investors of German or Australian origin in 2021 exceeded the number of notice filings by persons of such origin.

Interestingly, filers from China appear to have concluded that they are unlikely to clear transactions through the declaration process. Filers from China filed three declarations in 2019 and five declarations in 2020 but only one in 2021. Filings from China in 2021 ranked 26th for declarations in 2021 while ranking 1st for notices.

Notices

There were 272 notices filed in 2021 compared with 187 notices filed in 2020 and 231 notices filed in 2019. Part of the decrease in notice filings between 2019 and 2020 is likely attributable to the expanded declaration process implemented under the FIRRMA-mandated rule changes in 2020. The increase from 2020 to 2021 reflects in part increased filing activity but also a substantial uptick in the number of cases that were withdrawn and re-filed. In 2021, of the 272 notices filed, 74 were withdrawn, and in 63 such instances the notices were subsequently re-filed (52 in 2021 and 11 in 2022).2 This marks a notable increase from 2020 for which CFIUS reported only 29 notices withdrawn and re-filed. The Report states that most of these re-filings occurred because it had identified a national security risk and additional time was needed to consider the proposed mitigation terms.

According to the Report, there were 11 instances in 2021 in which the parties abandoned the transaction after withdrawal; of those, CFIUS reports that nine occurred because CFIUS was unable to identify mitigation measures that would resolve identified national security risks or because the mitigation measures requested by CFIUS proved unacceptable to the parties; the other two were abandoned by the parties for commercial reasons.

Geographic and Sectoral Distribution

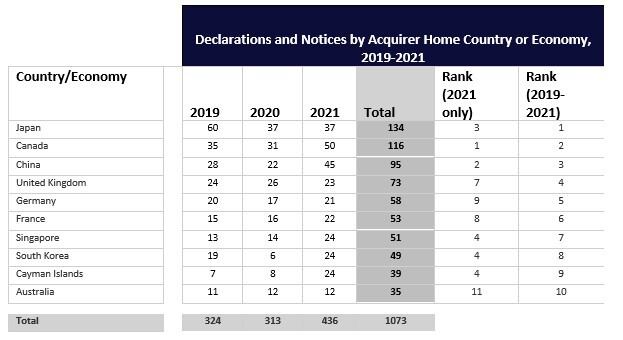

For looking at the geographical and sectoral distribution of CFIUS filings, it may be more useful if declarations and notices are combined. Such combination looks at overall demand for CFIUS review from various countries and regions and for various sectors.3 A table setting forth this information is set forth below.

Almost no matter how the filings are sorted and ranked, for the past three years Canada, China and Japan occupy the top three spots for frequency of filings of declarations and notices. Another possible trend worth noting is that, at least in 2021, Singapore, South Korea and the Cayman Islands have each made a significant upward move in terms of their seeking CFIUS clearance. Looking only at 2021, that triad of countries displaced the United Kingdom, Germany and France in the typical top six countries of origin. Whether this is a blip or a trend remains to be seen.

Among U.S. business sectors seeing the most covered transaction filings in 2021, the power sector saw the most activity. Filers submitted nine declarations and 30 notices for covered transactions in U.S. businesses in the electric power generation, transmission, and distribution industry group (by four-digit NAICS code designation). Covered transactions involving U.S. software publishing firms were the subject of 11 declarations and 27 notices in 2021, and covered transactions involving U.S. computer system design firms for professional, scientific, and technical services were the subject of ten declarations and 17 notices.

Critical Technologies

In 2021, CFIUS reviewed 184 covered transactions involving the acquisition of U.S. critical technology businesses. In contrast, in 2020 CFIUS reviewed 122 critical technology acquisitions and in 2019 it reviewed only 92. Of the 184 critical technology covered transactions in 2021, the largest number of notices filed involved acquisition of U.S. businesses in the professional, scientific and technical services sector with 35 filings and the computer and electronic product manufacturing industry subsector (by three-digit NAICS code designation) with 31 filings. Notably, these two sectors garnered the largest number of notices in 2019 and 2020 as well. Despite the significant focus in this area, the Report notes that CFIUS considered acquisitions of critical technologies across all industries, including looking at past acquisitions as appropriate.

Mitigation

According to CFIUS, of the 272 notices filed in 2021, 26 (just under 10%) were cleared with mitigation. This amounts to a slightly higher percentage of transactions than in 2020. Subtracting re-filed, withdrawn, and cleared with mitigation notices, CFIUS appears to have cleared a slightly lower percentage of notices in 2021 without mitigation (approximately 82% in 2021 compared with 86% in 2020).

Real Estate Transactions

There were a limited number of real estate filings made under CFIUS’s part 802 rules in 2021: six notices and one declaration were filed for real estate. These seven filings fall far short of CFIUS’s 2020 projections under its proposed FIRRMA regulations of 150 real estate notices per year and 200 real estate declarations per year. It is not immediately clear why real estate filings fell so far short of CFIUS estimates.

*****

The national security, mergers and acquisitions and competition practices at Hunton Andrews Kurth LLP will continue to monitor the development of this rulemaking and other CFIUS and cross-border investment matters. Please contact us if you have any questions or would like further information regarding the proposed rules or CFIUS, or require our assistance in submitting written comments on the Final Rules.

1 In 2020, declarations were available for all types of transactions for only ten and a half months. In 2019, declarations were only available for transactions involving “critical technologies.”

2 It appears that CFIUS does not publish data on the number of “unique” filings each year. Thus, it is possible that the reported 272 notice filings in 2021 were really something closer to 210.

3 This combination may be distorted slightly by the fact that approximately 18% of declaration filers were asked to file a full notice in 2021 (and thus that there might be some duplication between declarations and notices). However, this problem of duplication already exists in the notice data where withdrawals and re-filings appear to be counted as “new” filings.